Business

Investors Withdraw Over $120 Million from Ether-Related Exchange-Traded Products

Investors have withdrawn more than $120 million from exchange-traded products related to Ether, signaling a significant shift in market sentiment.

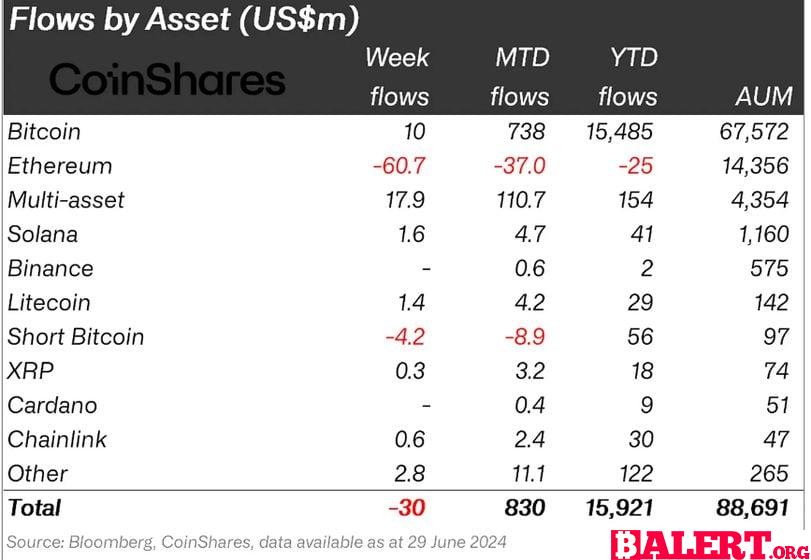

Professional investors have withdrawn more than $120 million from exchange-traded products (ETPs) linked to ether (ETH) over the past two weeks, according to a report released by crypto firm CoinShares on Monday. The outflows reached $60 million each week, marking the highest level since August 2022.

On the other hand, multiasset and bitcoin (BTC) ETPs experienced inflows of $18 million and $10 million, respectively, indicating a potential shift in sentiment among investors.

With ether ETFs on the verge of being available for trading in the United States after the recent approval of applicants’ filings by the Securities and Exchange Commission (SEC), the next hurdle is the approval of their S-1 filings before the products can hit the market.

Galaxy and Bitwise are among the firms anticipating significant interest in ether ETFs. Galaxy predicts potential net inflows of $5 billion within the first five months of launch, while Bitwise is even more optimistic, expecting as much as $15 billion in inflows during the initial 18 months.

The demand for these upcoming products is likely to come from independent investment advisers and broker/dealer platforms, as the market eagerly awaits the introduction of ether ETFs.