Tech

Sudden Shutdowns of Windows Computers Worldwide: Major Outage and Its Effects

A comprehensive review of the reasons for sudden shutdowns of Windows computers worldwide, major outages, and the effects of this situation on users. Informative content on solutions to the problems and potential future impacts.

A Major Outage Worldwide: Windows Computers Suddenly Shut Down

Television channels, airports, and banks around the world are facing a major outage that has caused computers running the Windows operating system to suddenly shut down. A program that was supposed to be broadcast live on Sky News on Friday morning was not aired due to an unexpected outage, and instead, old archive footage was shown. This situation caused great confusion among viewers.

A website that monitors outages, Downdetector, reported a sudden increase in issues across many platforms including Microsoft applications, banking websites, and airline apps. Many airlines warned their passengers to arrive at airports early, stating that the disruptions on their websites were due to third-party IT issues affecting their entire network.

Cybersecurity researcher Troy Hunt shared on the X platform that individuals worldwide were experiencing sudden “blue screen” errors on their Windows computers, entering recovery mode, and stated, “Something very strange is happening right now.”

Possible Cause

Experts suggest that a possible source of this widespread issue could be an antivirus software. It is claimed that recent updates to some popular antivirus programs have shown incompatibility with Windows’ core components, leading to system crashes. Cybersecurity engineers pointed to Crowdstrike as the antivirus software causing these crashes. Senad Arun, founder of the cybersecurity research company Imperum, described the situation as “Crowdstrike Doomsday.” Crowdstrike stated on its website, “Crowdstrike is aware of crash reports on Windows related to the Falcon Sensor.”

Turkish Airlines Made a Statement

Turkish Airlines (THY) Press Consultant Yahya Üstün announced on social media that there were disruptions in ticketing and reservation processes due to issues in information systems. He emphasized that necessary work was being done to resolve the issue and that precautions were taken to avoid inconveniencing passengers. Üstün stated that they would provide detailed information on the matter as soon as possible.

“Our operations are gradually returning to normal.”

In a second statement, THY Press Consultant Üstün said, “Dear passengers, it has been determined that a software-related problem has affected many companies from various sectors, including aviation, worldwide. Necessary actions are being taken to resolve this issue in our partially affected operations. Our operations are gradually returning to normal. We apologize to our valued guests for the inconvenience caused.”

Denizbank Also Made a Statement

In a statement from Denizbank, it was said, “Dear Customers, due to a technical malfunction of the global software system we use, outages are occurring in many institutions in our country as well. Our bank is working to resolve this issue and to restore all our channels to service as soon as possible. Thank you for your understanding.”

Tech

Tesla Semi Fire: NTSB Preliminary Report Released

The NTSB’s preliminary report on the Tesla Semi fire has been released. This content includes important information about the details of the incident, the causes of the fire, and Tesla’s safety measures. Explore the impact on Tesla’s electric vehicles and its future steps.

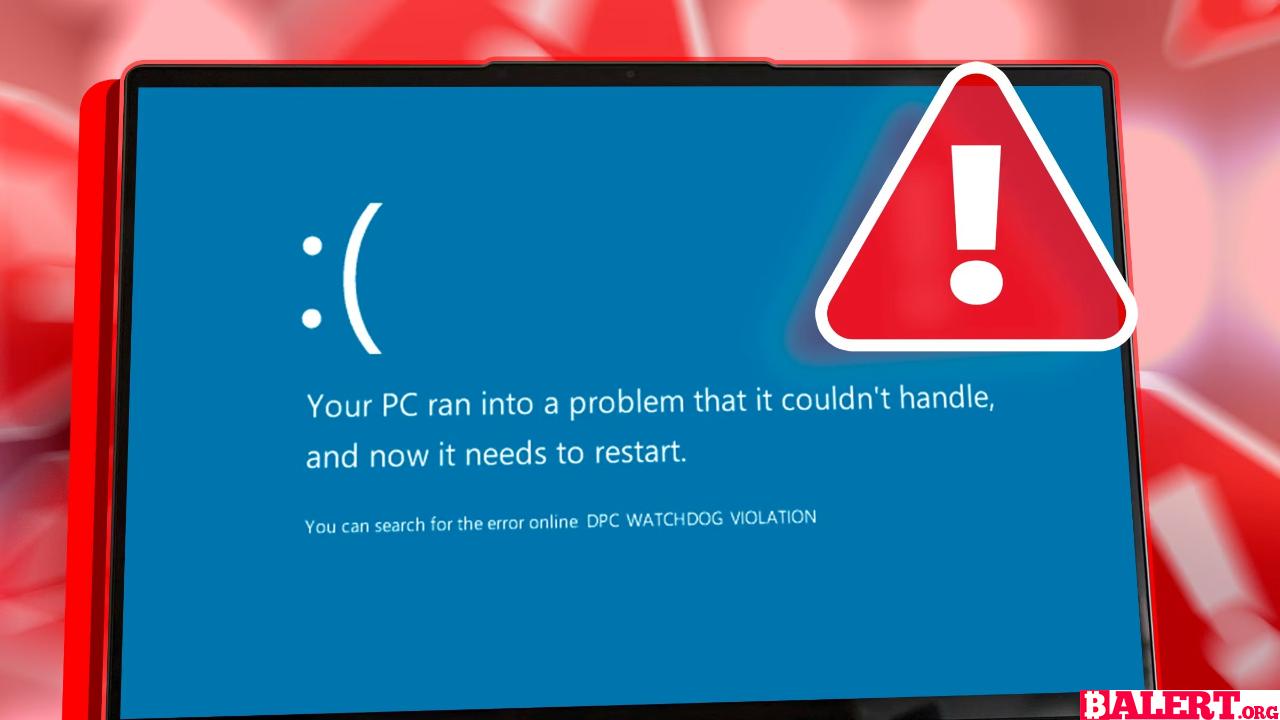

The National Transportation Safety Board (NTSB) released a preliminary report stating that a Tesla Semi electric truck in California required firefighters to use “50,000 gallons” (approximately 190,000 liters) of water to extinguish a roadside fire. Firefighting teams also deployed an aircraft to drop fire retardant on nearby areas as a precautionary measure to control the fire.

The accident occurred on August 19 at 3:13 AM local time on the I-80 highway east of Sacramento. The electric truck went off the road while navigating a curve, collided with a roadside boundary marker, and then struck a tree, coming to a stop. Fortunately, the driver was not injured in the accident; however, considering their health condition, they were taken to the hospital.

The Tesla Semi’s large 900 kWh battery caught fire upon impact, and toxic smoke began to spread during the fire. While the fire continued with temperatures reaching up to 538°C, firefighters worked intensively to cool the blaze with water. However, due to the fire’s effects, the vehicle continued to burn until late in the afternoon. Meanwhile, Tesla sent a technical expert to the scene regarding fire safety and high voltage hazards.

The highway reopened to traffic at 7:20 PM local time, 16 hours after the accident. The NTSB, as an organization that can only make recommendations and cannot enforce regulations, sent a team to the area for investigation purposes. This major accident raised several issues, including dangerously hot fires and toxic smoke, which will attract the attention of many international organizations.

The NTSB had previously stated in 2021 that fires in the batteries of electric vehicles pose serious risks to emergency response teams and that the guidelines provided by manufacturers for such fires are inadequate.

Tech

New Leaks and Features About the Samsung Galaxy S25 Ultra

Discover the latest leaks and features about the Samsung Galaxy S25 Ultra. Equipped with new technologies and advanced features, this smartphone elevates the user experience to a new level. Check it out for details!

New Leaks About Samsung Galaxy S25 Ultra

Samsung is expected to introduce the Galaxy S25 Ultra along with the Galaxy S25 series at the beginning of 2024, likely in January. Although no official announcement has been made yet, leaks regarding the upcoming flagship continue to spread rapidly on the internet. Notable leak source IceUniverse shared several new visuals of the Galaxy S25 Ultra in a post on the X platform. These visuals reveal the design differences between the Galaxy S25 Ultra and the Galaxy S24 Ultra.

One of the notable features in the leaked images of the Galaxy S25 Ultra is the rounded corners of the phone. In contrast, this year’s Galaxy S24 Ultra has quite sharp corners, which has led to feedback from some users indicating discomfort while holding the device. Previous leaks have suggested that the Galaxy S25 Ultra may be somewhat larger.

A tweet shared by IceUniverse: Galaxy S25 Ultra Image

According to leaks, the Galaxy S25 Ultra is expected to be thinner and lighter compared to previous models. In August, rumors emerged that the upcoming Galaxy S25 Ultra would be lighter than its competitors, with a weight of under 221 grams.

Another image featured in IceUniverse’s post shows close-ups of the sides of both next year’s expected flagship phone and Samsung’s current flagship. In this image, the side of the Galaxy S25 Ultra appears flatter with rounded corners. While these changes may not create a major revolution, they will generally positively affect the feel of the phone in hand.

Looking at other rumors about the Samsung Galaxy S25 Ultra, it is expected that the company will offer top-tier screen and camera upgrades next year. Additionally, there is a strong expectation that the satellite connection feature will also be introduced alongside the Galaxy S25.

Tech

iOS 18 Officially Released: Innovations and Features

iOS 18 has been officially released! This update, packed with new features and innovations, elevates the user experience to the next level. Check out our article for details and discover the new offerings of iOS 18!

iOS 18 Officially Released: Here Are the Innovations!

Apple officially launched iOS 18 yesterday, as promised. After a long beta testing phase, this update brings many exciting new features for iPhone users.

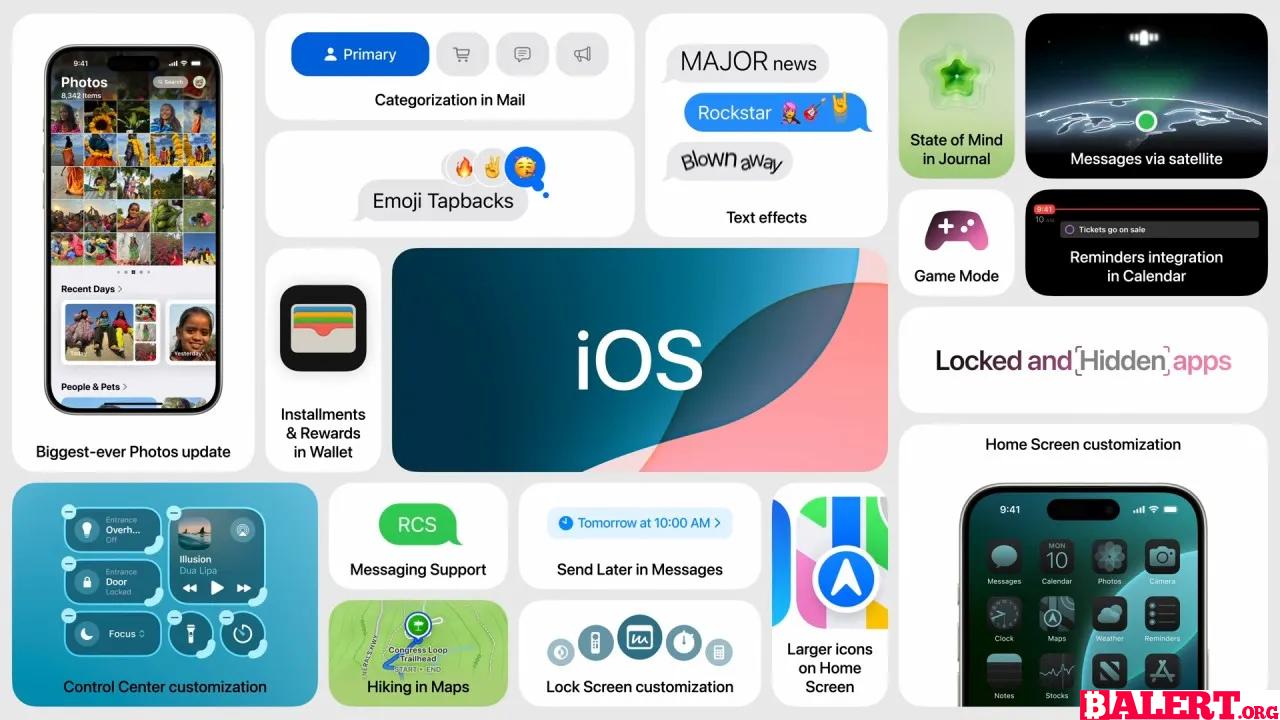

New Features in iOS 18

- Advanced Customization Options on the Home Screen: With iOS 18, users can now arrange app icons freely without sticking to the traditional grid layout. Additionally, there’s an option to change the colors of the icons and adjust their darkness levels. In short, you are no longer bound to a boring layout. It raises questions why Apple waited until 2024 to offer this feature.

- Revamped Control Center: The Control Center is completely redesigned in iOS 18. Users will be able to group controls more comfortably, and developers can easily add controls from their applications. Also, there’s an option to divide the Control Center into pages, allowing different controls on each page.

- RCS Messaging Support: With iOS 18, Apple introduces Rich Communication Services (RCS) messaging support. Users can add various effects to their texts and react with new emojis for more colorful responses.

- Updated Photos App: The Photos app is presented with a new opening page and a modern layout. Users can now browse photos by time, people, and many other criteria, reorder media files, and explore more with the “Collections” feature.

- App Lock Feature: Users can now lock specific applications. For example, they can activate Face ID protection from the menu that appears when long-pressing an app icon. Thus, anyone wanting to open the app will have to pass the Face ID protection first.

- Apple Intelligence: One of the important features of iOS 18 is Apple’s artificial intelligence kit, Apple Intelligence. However, to fully benefit from this feature, you’ll need to wait for the iOS 18.1 update. More information about Apple Intelligence can be found here.

How to Install iOS 18?

- Open the Settings app.

- Tap on General.

- Select Software Update.

- Your iPhone will notify you that the new iOS 18 update is available.

- Click on “Download and Install” and follow the on-screen instructions.

Which iPhone Models Can Install iOS 18?

- iPhone XR, XS, and XS Max

- iPhone 11

- iPhone 11 Pro and 11 Pro Max

- iPhone SE (2nd generation)

- iPhone 12 mini and iPhone 12

- iPhone 12 Pro and iPhone 12 Pro Max

- iPhone 13 mini and iPhone 13

- iPhone 13 Pro and iPhone 13 Pro Max

- iPhone SE (3rd generation)

- iPhone 14 and iPhone 14 Plus

- iPhone 14 Pro and iPhone 14 Pro Max

- iPhone 15 and iPhone 15 Plus

- iPhone 15 Pro and iPhone 15 Pro Max

- iPhone 16

- iPhone 16 Plus

- iPhone 16 Pro and iPhone 16 Pro Max

-

Business4 months ago

Business4 months agoObituary: Dan Collins

-

Business3 months ago

Business3 months agoThe Significance of Jackson Hole: A Central Banking Tradition

-

Gaming5 months ago

Gaming5 months agoMore than a thousand students vowed not to work for Amazon and Google due to the Nimbus Project.

-

World5 months ago

World5 months agoRussia and North Korea Strengthen Defense Ties

-

Business5 months ago

Business5 months agoJump Crypto Invests $10 Million in Pro-Crypto PAC

-

Article5 months ago

Article5 months agoCreative Design Applications Developed with Artificial Intelligence

-

Tech2 months ago

Tech2 months agoNew Leaks and Features About the Samsung Galaxy S25 Ultra

-

Gaming5 months ago

Gaming5 months agoThe Inspirational Success Story of Avon’s Founder Who Sold Books Door to Door