Business

Market Focus: U.S. CPI Data and Bitcoin Price Movement

Explore the impact of U.S. CPI data on the fluctuations in Bitcoin prices, highlighting market trends and insights for investors and traders.

With the supply overhang from Germany’s Saxony state nearly cleared, the upcoming release of the U.S. consumer price index (CPI) report is highly anticipated in shaping the trajectory of the bitcoin (BTC) market.

The data, scheduled for release at 12:30 UTC (8:30 ET), is expected to reveal a 0.1% month-over-month increase in the cost of living for June, following a stagnant May. Economists surveyed by Dow Jones project a 3.1% year-over-year rise. The core CPI, excluding volatile food and energy prices, is forecasted to show a 0.2% increase from May and a 3.4% rise since the previous June.

If the reported figures align with expectations, it would signal progress towards the Federal Reserve’s 2% inflation target, potentially paving the way for anticipated rate cuts later this year.

Prospects of rate cuts are likely to favor risk assets, such as bitcoin, aiding its recovery from the recent lows around $53,500. However, the cryptocurrency’s price recovery has stalled, with resistance noted around the $59,000 mark, according to CoinDesk data.

Algorithmic trading firm Wintermute highlighted the significance of the CPI data, noting that market reactions are expected to be significant. Analysts’ positive outlook for late 2024 and 2025 hinges on the Fed’s policy rate reductions, as lower rates typically drive investors towards assets like cryptocurrencies.

The inflation rate has substantially decreased from its 2022 peak of 9.1%, yet the Fed emphasizes the necessity for further progress on inflation before adjusting high interest rates. Fed Chair Jerome Powell reiterated this stance during his recent Congressional testimony, indicating that the central bank won’t wait for inflation to reach 2% before considering rate cuts.

According to the CME’s FedWatch tool, following a weak payrolls report, traders have priced in a 70% chance of a Fed rate cut in September, with increasing odds of another cut in December.

Market Impact: U.S. Treasury Yields and Bitcoin Sentiment

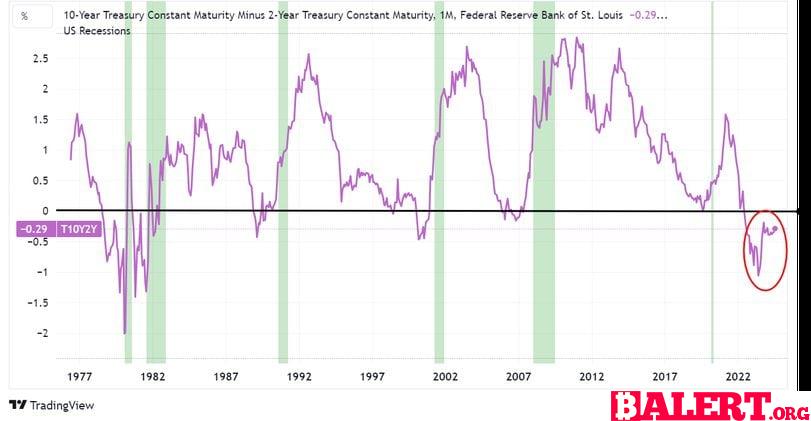

The response of the U.S. Treasury yield curve to the anticipated soft CPI release may influence broader market sentiment, including the bitcoin market.

Expectations of slower inflation and heightened rate cut probabilities can drive up prices of the two-year note, pushing its yield lower. Conversely, concerns over larger budget deficits under a potential Trump presidency may keep the yield on the 10-year note elevated.

This scenario could lead to a bull steepening of the yield curve, where the spread between 10- and two-year notes widens. The current inverted curve, with higher yields on two-year notes, may normalize rapidly during periods of economic contraction, signaling risk aversion.

Historically, bull steepening has coincided with recessions, such as in 1990-1992, 2001, 2003, 2008, and 2020, resulting in poor equity performance. Notably, a sharp steepening often precedes economic downturns.

Noting the recent curve steepening due to U.S. political uncertainty, analysts suggest a potential Trump victory could trigger inflation from tariffs and increased issuance to fund tax cuts. Investment banks like JPMorgan and Citi are anticipating further steepening of the yield curve.