Business

Exploring the Volatility of Crypto: Feature or Bug?

Dive into the fascinating world of cryptocurrency as we explore its inherent volatility. Is it a feature that drives innovation and opportunity, or a bug that risks financial stability? Join us in uncovering the truth behind crypto’s wild price swings.

Is Crypto’s Volatility a Feature or a Bug?

In this week’s edition, Miguel Kudry, the CEO of L1 Advisors, delves into the performance of cryptocurrencies and their intricate relationship with market conditions. In our Ask an Expert segment, Kevin Tam from Raymond James Ltd. provides insights on institutional filings with the U.S. Securities and Exchange Commission (SEC) and what these can reveal to advisors about the adoption of digital assets.

You’re reading Crypto for Advisors, CoinDesk’s weekly newsletter that unpacks digital assets for financial advisors. Subscribe here to receive it every Thursday.

In Tumultuous Times, Volatility in Crypto is a Feature, Not a Bug

On Monday, August 5, the Japanese Nikkei index suffered a staggering drop of over 12%, marking its most significant crash since 1987. This dramatic decline followed unsettling announcements from Japan’s central bank regarding potential interest rate hikes. Analysts speculated that this decision stemmed from fears of an impending U.S. recession, while others linked it to conjecture about rate cuts from the Federal Reserve. Such uncertainty disrupted the Japanese carry trade, a strategy estimated to be worth about $1.1 trillion by economists at TSLombard, triggering a global capital market panic as investors scrambled to unwind positions.

During this turmoil, the crypto markets experienced a severe impact on Sunday evening as investors sought the quickest route to liquidity. Bitcoin and ether saw substantial drops of 15% and 22%, respectively, with much of this decline occurring during the Sunday night hours in U.S. Eastern Time (ET).

Contrary to common perceptions, the inherent volatility of crypto markets should be viewed as a feature rather than a flaw. With no circuit breakers to halt trading, the always-on and globally accessible nature of crypto markets often positions them as the primary source of liquidity for investors. During periods of panic, crypto may be the only asset class available for liquidation, as was demonstrated on that fateful Sunday evening in the Western Hemisphere. By the time the U.S. stock market opened on Monday morning, crypto markets had already begun to stabilize, with both bitcoin and ether recovering approximately 10% from their respective lows.

Crypto markets consistently deliver liquidity and availability, even in the midst of chaos. On August 5, several major online brokerages—including Schwab, Fidelity, Robinhood, and Vanguard—experienced outages or were undergoing maintenance, leaving tens of thousands of investors unable to access their portfolios or execute trades. Schwab attributed the outage to a “combination of higher volumes and a technical issue with a key vendor affecting [their] systems,” shedding light on the opaque software and backend systems prevalent in traditional finance. In stark contrast, Bitcoin has demonstrated an impressive 99.98918% uptime throughout its existence, while Ethereum has never gone offline, showcasing the reliability of digital assets when conventional financial systems falter.

As other asset classes begin to transition to crypto rails—often referred to as on-chain—they stand to gain from the inherent accessibility of digital assets. Early adopters are likely to seize arbitrage opportunities that arise between on-chain and off-chain markets. Over time, this accessibility will likely become standard for a new generation of investors who are increasingly disenchanted with traditional market structures. A recent report from Bank of America highlights this shift, indicating that “older investors hold significantly more traditional equities, while younger groups tend to favor crypto and alternative investments.”

During periods of uncertainty, the enhanced accessibility to an investor’s portfolio can mitigate volatility and panic across all asset classes, including crypto-native tokens. An analysis by Amberdata reveals that “the dispersion of volatility across different regions underscores the significant impact of market openings and closings on price movements.” This implies that greater accessibility could play a crucial role in stabilizing markets during critical moments, offering a buffer against extreme price fluctuations.

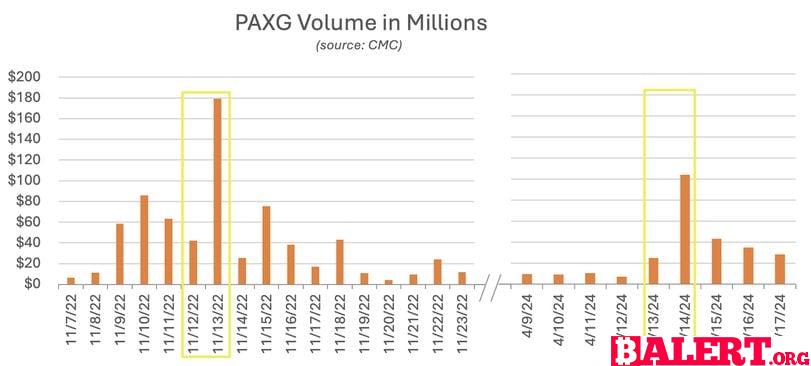

Earlier this year, as geopolitical tensions escalated between Iran and Israel, PAXG, a tokenized version of gold, traded at a staggering 20% premium over its closing price on Friday, April 12. Such sharp price movements highlight the stark contrasts in flexibility between traditional markets and those utilizing crypto or on-chain formats. This volatility is further evidenced by PAXG’s trading volumes, which tend to spike over weekends and particularly on Sundays, underscoring the dynamic nature of crypto markets compared to their more rigid traditional counterparts.

Source: @Kaledora, who wrote a comprehensive X thread on this subject.

In conclusion, the intrinsic volatility of crypto markets and on-chain assets, especially during turbulent times, highlights the unique characteristics that differentiate them from traditional markets and off-chain assets. The always-on nature of crypto markets, free from circuit breakers, ensures that they remain accessible even when conventional markets falter, providing liquidity exactly when it is needed. As a growing number of assets transition to on-chain rails, this availability will become increasingly crucial, potentially lessening panic and volatility across the broader global financial ecosystem.

– Miguel Kudry, CEO, L1 Advisors

Ask an Expert

Q. How can investors use the SEC 13F or SEDAR filings for due diligence?

As a valuable research tool, these filings can provide investors with insights into the investment strategies and holdings of major institutional managers, often referred to as “smart money.” This information can assist in identifying successful strategies, recognizing market trends, and determining where funds are directing their capital. From a regulatory compliance standpoint, these filings can enhance investor confidence by promoting greater transparency and integrity within the traditional finance (TradFi) markets.

In Canada, SEDAR (System for Electronic Document Analysis and Retrieval) serves a similar purpose to the U.S. SEC’s EDGAR (Electronic Data Gathering, Analysis, and Retrieval). Both platforms enable publicly traded companies to electronically file their financial and regulatory documents, functioning akin to a permissionless and open ledger, much like a blockchain network.

Q. Why would a pension fund or bank consider adding bitcoin to their portfolio?

This move signals a broader acceptance of digital assets as integral components of investment strategies. It can be seen as a response to persistently low interest rates and inflation concerns, while also providing diversification and potential for enhanced returns. For instance, the State of Michigan Retirement System allocated $6.5 million to the Ark 21Shares bitcoin ETF in the second quarter of this year.

Additionally, several Canadian banks, including TD Waterhouse Canada, CIBC World Markets, and National Bank, have incorporated bitcoin ETFs into their latest Q2 13F filings. Collectively, these major banks have reported owning a total of $26.6 million in these spot bitcoin ETFs over the last two quarters. I firmly believe that bitcoin represents a long-duration, institutional-grade asset with the potential for asymmetric return profiles, offering substantial upside while limiting downside risks.

Q. What’s the latest buzz surrounding spot bitcoin and spot ethereum ETFs?

ETFs began to become available in early 2024 and have quickly gained popularity, attracting significant inflows of capital. As of now, total assets under management for these 10 spot bitcoin ETFs have reached around $62.3 billion.

In July, the launch of the spot Ethereum ETF made it even easier for investors to enter the digital asset space through traditional financial markets. In just a few weeks, the spot Ethereum ETF witnessed a remarkable total net inflow of $17 billion across eight different ETFs. This marks a significant evolution in digital asset investing, particularly with the introduction of ETF products, which enhance both accessibility and legitimacy for a wide range of investors.

– Kevin Tam, Digital Asset Research Specialist & Senior Branch Compliance Supervisor, Raymond James Ltd.

Keep Reading

Business

Bhutan’s Strategic Investment in Bitcoin: A New Era for the Himalayan Kingdom

Explore how Bhutan is embracing Bitcoin as a strategic investment, marking a transformative shift for the Himalayan kingdom. Discover the implications of this move on its economy, sustainability, and future in the digital age.

Buddhist Kingdom’s Bold Move into Bitcoin

A stunning landlocked nation nestled between India and China, Bhutan has made headlines by accumulating significant bitcoin (BTC) holdings totaling over $780 million in recent years. This amount represents nearly one-third of the country’s gross domestic product (GDP), positioning Bhutan as the holder of the fourth-largest state-owned stash of BTC, as revealed by the on-chain analytics tool Arkham.

Known for its unique approach to governance, Bhutan emphasizes the happiness of its fewer than 900,000 citizens as a more meaningful metric of well-being than traditional economic indicators. This Himalayan kingdom has become the second nation, following El Salvador, to officially embrace BTC as part of its national strategy, incorporating it into the state-owned Druk Holdings fund.

According to Arkham, Bhutan has established bitcoin mining facilities across various locations, with the most significant operation situated on the site of the now-defunct Education City project. Unlike many governments that acquire BTC through asset seizures related to law enforcement, Bhutan’s holdings have originated from extensive bitcoin mining activities, which have seen a remarkable increase since early 2023.

These mining operations are likely connected to Bitdeer (BTDR), a prominent player in the cryptocurrency mining sector. In 2023, the Singapore-based firm announced its collaboration with the Bhutanese government to develop cryptocurrency mining operations in Southeast Asia, successfully raising over $500 million for this ambitious venture. Following this announcement, Bitdeer disclosed that it had completed the first phase of a 100 megawatt (MW) mining facility.

Looking ahead, Bitdeer announced plans to expand Bhutan’s mining capacity to a staggering 600 MW by 2025, reflecting the growing significance of this initiative.

Despite its small geographic size, even smaller than Switzerland, Bhutan faces challenges such as limited economic diversification and an underdeveloped private sector. The nation primarily relies on sectors like hydropower, tourism, and agriculture to generate revenue. In 2022, Bhutan’s GDP was recorded at just under $3 billion, approximately half that of the Maldives.

To bolster its economy, Druk Holdings is exploring opportunities across various sectors. The organization’s website highlights “digital assets” as a key focus area in its technology-driven investment strategy, which also includes projects in hydropower and emerging digital realms like the metaverse.

Recent activities in the Druk wallets, as monitored by Arkham, indicate a flurry of deposit and withdrawal transactions in recent weeks. The fund has received multiple deposits of up to 2 BTC from Foundry, another mining entity, as well as from other unidentified bitcoin addresses during the past week. Additionally, Druk Holdings has periodically transferred bitcoin to various addresses, including crypto exchanges. One notable transaction from early July involved a transfer of over $25 million worth of BTC sent to the crypto exchange Kraken, suggesting that it was likely sold to capitalize on market conditions.

Business

Bitcoin and Crypto Markets React to Anticipated Federal Rate Cuts

Explore how Bitcoin and cryptocurrency markets are responding to the anticipated Federal rate cuts. Discover the implications for investors and the broader financial landscape in this insightful analysis.

Bitcoin and Crypto Markets Await Federal Rate Cuts

Bitcoin (BTC) and the broader cryptocurrency markets have seen minimal fluctuations over the past 24 hours as traders remain cautious ahead of the upcoming Federal Open Market Committee (FOMC) meeting on Wednesday. This meeting is particularly significant, as officials are anticipated to announce the first interest rate cuts in four years. Currently, Bitcoin is trading just below $58,500, specifically at $58,480, reflecting a relatively stable performance. The CoinDesk 20 (CD20), a benchmark for the largest digital assets, has experienced a slight increase, trading above the 1,800 mark.

In terms of daily activity, inflows into Bitcoin exchange-traded funds (ETFs) have amounted to $12.9 million, with a substantial portion directed towards BlackRock’s IBIT. Analysts widely expect the Fed to unveil a rate cut on September 18, signaling the beginning of a potential easing cycle that has historically provided support for risk assets, including Bitcoin.

As of Tuesday morning in Asia, the 30-Day Fed Funds futures prices indicate that traders perceive a 67% likelihood of a significant 50 basis points rate cut, bringing the target range to 4.7%-5%. This is an increase from Monday’s implied probability of 50% and a notable rise from the 25% probability reported a month ago. On Polymarket, traders are assigning a 57% chance of a decrease exceeding 50 basis points, alongside a 41% chance of a 25 basis points cut.

Meanwhile, the overall market remains relatively stable. Noteworthy movements have been observed, such as XRP rising by 3.5%, SUI increasing by 2.5%, and Fantom’s FTM surging by 10.5%, buoyed by positive market sentiment surrounding its forthcoming rebranding to Sonic.

Trump’s World Liberty Financial to Introduce WLFI Token

In other news, the team behind World Liberty Financial, a project receiving endorsement from former President Donald Trump and his family, has announced the launch of a governance token. However, it is crucial to note that this token will only be available to accredited U.S. investors. During a livestream that lasted over two hours, the team highlighted that the token is intended for governance participation rather than for economic profit and did not disclose a specific launch date during the X Spaces stream.

Throughout the livestream, Trump himself did not specifically mention the token or provide an endorsement. Instead, he reiterated his general views on cryptocurrency policy, much of which echoed his previous public statements, including those made at the recent Bitcoin Conference held in Nashville.

Figure Markets Launches Exchange with Real Estate-Backed Yields

In a groundbreaking development within the crypto space, Figure Markets has announced the launch of its exchange, coinciding with the Token2049 event in Singapore. Founded by Mike Cagney, a co-founder of SoFi, Figure Markets introduces an innovative method for generating yields for users who store their cryptocurrency on the platform.

According to a recent release, Figure Markets claims it can offer returns of up to 8% for non-USD and stablecoin balances. This is achieved by leveraging a fund backed by real-world assets, particularly home equity loans. The operational model involves traders depositing their funds into Figure Markets, which are then pooled and lent to Figure Technologies for the issuance of secured home equity loans. The interest paid by borrowers on these loans creates a spread that not only covers operational costs but also provides returns to investors. These investors benefit from dual recourse protections, daily liquidity, and interest payments that accrue based on the duration of their investments.

While Real World Assets (RWAs) are progressively becoming a noteworthy aspect of the cryptocurrency industry, there are still very few applications that seek to derive yield from these assets to support their operations. Prior to the launch of Figure in 2023, Cagney had withdrawn the company’s bid for a U.S. federal bank charter amid regulatory scrutiny, opting instead to pursue partnerships with established banks.

Business

Meta Bans Russian Media Outlets Amid Disinformation Concerns

In response to rising disinformation concerns, Meta has imposed bans on several Russian media outlets. This decision highlights the ongoing battle against misinformation and the platform’s commitment to ensuring accurate information for its users.

Meta Takes Strong Action Against Russian Media Outlets

On Monday, Meta announced a significant initiative to prohibit Russian media outlets, including the state-funded television network RT, from utilizing its platforms. This decision comes in light of ongoing scrutiny in the United States regarding these outlets’ involvement in covert influence campaigns designed to manipulate online discourse across various social media platforms.

Meta, the parent company of popular applications such as Facebook, Instagram, and WhatsApp, stated that the ban would be implemented in the coming days. This decisive action marks an escalation in the ongoing efforts to combat Russian state media actors, which U.S. intelligence officials have identified as key players in disinformation operations that span the globe, infiltrating the world’s largest social networking sites.

In a formal statement, Meta expressed, “After thorough consideration, we have expanded our current enforcement measures against Russian state media outlets. Rossiya Segodnya, RT, and other related entities are now prohibited from our applications worldwide due to their involvement in foreign interference activities.”

Recently, U.S. authorities have tightened their grip on RT, particularly for its attempts to meddle in the upcoming presidential election scheduled for November. On Friday, the United States, in conjunction with Canada and Britain, accused RT of functioning as a conduit for Russian intelligence agencies. They announced new sanctions aimed at curtailing international funding sources that support disinformation campaigns globally.

This crackdown follows the federal indictment of two RT employees, who allegedly funneled at least $9.7 million to finance American podcasters on Tenet Media, a video-streaming service based in Tennessee. The goal was to amplify the Kremlin’s propaganda and undermine the integrity of the American democratic process.

Secretary of State Antony J. Blinken emphasized the broader implications of these tactics, stating, “We’re revealing how Russia employs similar strategies globally.” He further noted, “The Russian weaponization of disinformation to destabilize and polarize free and open societies is a challenge that impacts every corner of the world.”

-

Business5 months ago

Business5 months agoThe Significance of Jackson Hole: A Central Banking Tradition

-

Tech4 months ago

Tech4 months agoNew Leaks and Features About the Samsung Galaxy S25 Ultra

-

Business7 months ago

Business7 months agoObituary: Dan Collins

-

Article7 months ago

Article7 months agoCreative Design Applications Developed with Artificial Intelligence

-

Business4 months ago

Business4 months agoBhutan’s Strategic Investment in Bitcoin: A New Era for the Himalayan Kingdom

-

World4 months ago

World4 months agoThierry Breton Resigns: Impact on European Union Leadership

-

Gaming4 months ago

Gaming4 months agoNew Details and Trailer Released for Dead Rising Deluxe Remaster

-

Gaming4 months ago

Gaming4 months agoNew Details for Alan Wake 2 and PlayStation 5 Pro Announcement